Data supports pharmacy invoice initiative

Data analytics continues to be a driving force in the OIG’s work. It improves the agency’s accuracy and efficiency, uncovering potential fraud, waste and abuse across the health care delivery system.

About Fraud Detection Operations

Data played a key role in a recent initiative to uncover questionable pharmacy practices. The Medicaid Program Integrity Division (MPI) conducted a Fraud Detection Operation (FDO) into potentially fraudulent billing practices around prescription drugs, namely billing for an expensive drug while dispensing a cheaper version.

An FDO reviews volumes of data to uncover providers who appear as statistical outliers among their peers. Throughout the operation, investigators evaluate additional records, invoices and information to determine whether an outlier’s status is attributable to possible fraud, waste, or abuse or other program violations. This advanced data analytics method of investigating issues reveals potential candidates for an audit or full-scale investigation.

How it’s done

The individual National Drug Code (NDC) numbers that identify drugs and their associated costs provide a clear picture of pharmacy activities. The OIG’s Data and Technology Team (DAT) developed algorithms to identify pharmacies across Texas exhibiting behavior that can be associated with fraudulent billing. Variables examined included:

- A spike in dollars per claim

- Script exhaustion or filling prescriptions past their validity date

- A high quantity/supply ratio per NDC that may indicate premature refills for reimbursement

- Filling odd quantities – which point to incorrect claim details

- Consistently high refill rates that may suggest auto-refilling.

DAT analyzed 100 million claims statewide, covering a five-year period. The FDO included a review of 2,000 pharmacies.

After identifying outlier pharmacies who exhibited unusual billing patterns, investigators requested invoices to compare NDCs purchased with NDCs billed.

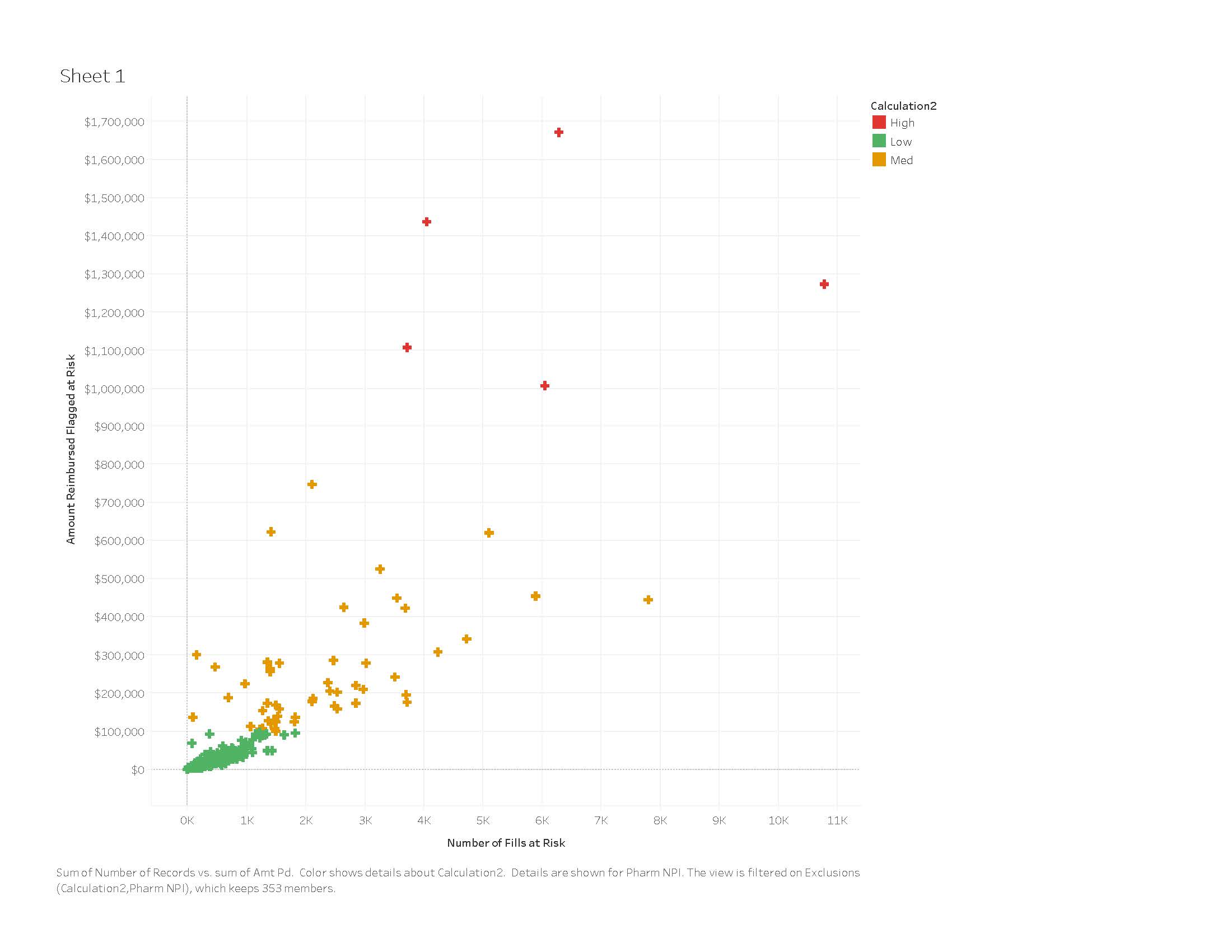

The graph above plots the number of refills against the dollar amounts at risk. While our algorithms detected suspicious billing patterns on multiple providers, degrees of risk are taken into account as the OIG decides whom to audit or investigate.

For example, the pharmacies in green are identified as outliers in terms of their behavior patterns but generally have low at-risk amounts, possibly due to explainable anomalies or low-frequency transgressions. However, the pharmacies whose behavior could pose a larger impact to the program (seen in red) are where we consider investigating. DAT ultimately identified four pharmacy providers in the Houston region who exhibited patterns of potential wrongdoing. MPI opened investigations on two of the pharmacies; those investigations are still in progress.

Additional data analysis performed for this initiative revealed weaknesses in MCO systems to flag payment on questionable pharmacy practices. Those findings are being shared with MCOs to help prevent future overpayments.

Moving forward

One of the OIG’s priorities this year is to advance its data analytics maturity. This is a multi-year pursuit that will implement several projects, including implementing more efficient data extraction processes, increasing the use of data visualization to enable the identification of concerning patterns, acquiring new data sources to incorporate into new types of analysis, and automating existing algorithms.

Dedicated staffers across OIG divisions analyze data and apply their experience and expertise to agency initiatives. This evolving approach to fraud detection and prevention is one way the OIG fulfills its mission to protect taxpayer dollars.